From three technology transfers to cooperative CMA architecture: the 10th anniversary of Geely’s acquisition of Volvo.

March 28th, 2020 is the 10th anniversary celebration of Geely’s acquisition of Volvo. Nowadays, from the status, good achievements and influence of brands such as Geely, Volvo and Lectra, it is undoubtedly proved that Geely’s acquisition of Volvo cars was successful 10 years ago today, no matter from which dimension. In fact, the simplest clue can be seen from the platform and products after the acquisition, so let’s review the mainstream models of various brands in the past 10 years.

In fact, after Geely acquired Volvo, Geely did not take the practice of exhausting resources and fishing, but "two tracks in parallel", which is what Li Shufu said: "Geely is Geely and Volvo is Volvo." Therefore, Geely not only does not dig the wall, but also spends money to jointly develop new vehicle platforms with Volvo. After many years, let’s see what changes have taken place in Geely and Volvo.

In order to better sort out the product changes of various brands after the acquisition, we will review them in turn with a clear timeline, and at the same time, we will also take stock of the architecture platforms jointly developed. After all, these are the cornerstones of various new models. Next, we will see the changes of Volvo (Asia-Pacific) and Geely in the core models, as well as the model history of the brand-new brand Lectra.

After the acquisition, technology transfer and shared research and development have become the cornerstones of new models.

At that time, at the end of 2010, Volvo released a new 2.0GTDi engine+Powershift powershift powertrain, but the Volvo S40, which was manufactured by Ford Chongqing Factory, was still equipped with a 2.0L engine and a 6-speed powershift, and then the 2012 model was launched, so it was discontinued and delisted.

2011 Volvo S40 manufactured by Ford Chongqing Factory.

After the acquisition of Volvo, Geely Holding Group began to prepare for "technology transfer" and "shared R&D" between Geely Automobile and Volvo. Until the establishment of the European R&D Center and Gothenburg Modeling Center was officially announced in 2013, during this period, most of Geely Automobile’s cars were also delisted one after another, leaving only Emgrand cars as the main sales in the market.

However, "technology transfer" is not so easy. Even if Geely Group acquired and obtained 100% control of Volvo, as well as more than 10,000 patents and intellectual property rights, it could not be used. After all, Volvo was previously owned by Ford, and many technologies were jointly developed by Ford and Volvo, not to mention that the Group still wanted to use it for Geely Automobile. Therefore, on the one hand, Geely Automobile obtained technology transfer without "limited authorization", on the other hand, it established a joint R&D center with Volvo and embarked on the development road of learning Volvo technology by itself.

Therefore, since 2013, the following events have occurred:

February 20, 2013:Geely Holding Group announced the establishment of Geely Automobile European R&D Center and Gothenburg Modeling Center, integrating the superior resources of its Volvo Cars and Geely Cars, and building a new generation of basic module architecture CMA and related components to meet the future market demand of Volvo Cars and Geely Cars. It was put into trial operation in September of the same year.

Three technology transfers between Geely and Volvo Geely welcomes the third generation of products.

Event focus:GMC upgrade platform, air quality control and safety innovation technology

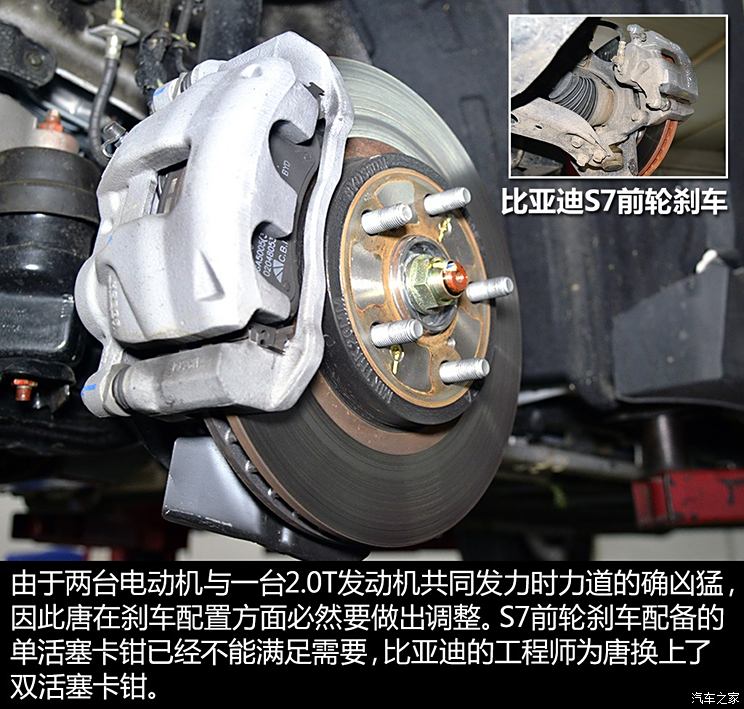

March 2013:Geely and Volvo reached a technology transfer. In August of the same year, Volvo transferred three technologies to Geely, including GMC upgrade platform, which is what we call a medium-sized car, and then the indoor air quality control system and GX7 safety innovation technology.

March 2013:Geely develops the third generation products based on KC platform extended by GMC.

KC concept car based on KC platform extended by GMC (production version is Borui) was released at the 2013 Shanghai Auto Show.

At the same time of technology transfer, Geely Automobile also began to develop its own third-generation products, and the first new car developed was Borui (internal code GC9). Borui is produced based on KC platform extended by GMC. The KC concept car was first released, and then the preview of the production model was released for the first time in September 2014, and the production car was released in mid-December of the same year, and it was announced as "Borui GC9", which was finally listed under the official name of "Borui" on April 9, 2015.

Borui’s appearance was not only designed by Peter Hobury, former vice president of Volvo Group, but also the chassis system was optimized by leannova, a supplier of chassis adjustment for Volvo. At the same time, the technologies such as urban pre-collision adaptive cruise and semi-automatic parking are also directly translated from Volvo.

Sweden establishes joint R&D center CEVT to develop CMA infrastructure module.

September 2013:Geely and Volvo set up a joint research and development center CEVT in Sweden

Event focus:The research and development of CMA infrastructure module has laid the foundation for the new models of Geely, Lectra and Volvo in the future.

Cevt (China Euro Vehicle Technology) is one of the four global R&D centers of Geely Automobile Group, located in Lindholmen Science Park in Gothenburg, Sweden, and is the headquarters of Lectra Engineering and Design Team.

CEVT gives full play to the advantages and resources of Geely and Volvo. At present, there are more than 2,000 outstanding automobile engineers from more than 20 countries, who are responsible for jointly developing CMA architecture and power system, as well as special basic theoretical research related to automobiles, including basic theories related to automobiles in the fields of mathematics, physics, chemistry, materials, voice interaction, active safety and air quality.

CMA architecture led by Volvo and jointly developed by Geely.

CMA modular platform:Led by Volvo Cars, Geely Automobile and Volvo Cars jointly developed a brand-new basic module architecture for mid-size cars. The platform has been developed in Geely Automobile European R&D Center (CEVT) for more than three years, and the wheelbase and length of cars can be adjusted according to the positioning of different models, covering the layout of small, compact and mid-size cars and the corresponding SUV products. In the future, a new generation of Volvo 40 series models will be born on this platform.

As an important part of vehicle development, powertrain is naturally the focus of CMA platform research. According to the news released at present, Volvo DRIVE-E series 2.0T engines and smaller displacement 1.5T engines, which have won the Top Ten Engine Awards of Ward for many times, will appear on the CMA platform. In addition, there will be plug-in hybrid and pure electric product planning in the future.

In addition to powertrain, CMA modular platform development mode will also directly enjoy the leading technology brought by Volvo, which has always been known for its safety technology, in the active and passive safety fields. Such functions as AEB active braking with pedestrian recognition function, driver fatigue reminder, and automatic far and near lights will all appear on CMA architecture models.

The road to the opening of new models under various brands

December 13th, 2013: After the acquisition, the first domestic Volvo model (S60L) was launched.

Official guide price: 269,900-384,900 yuan.

New car features:Geely’s first domestic Volvo model after its acquisition of Volvo has become larger in size and 80mm in wheelbase, and the whole system comes standard with urban safety system.

In 2010, Geely completed the acquisition of all the shares of Volvo cars, and Volvo S60L was the first domestic model owned by Geely. The domestic Volvo S60L, which was launched in 2013, has launched five models, and the official guide price is 269,900-384,900 yuan.

The domestic Volvo S60L continues the exterior modeling and interior design of the overseas version S60L, but the biggest difference lies in the change of body size. The length, width and height of S60L are 4715mm/1866mm/1481mm, and the wheelbase is 2776mm, which is 80mm higher than that of the overseas version S60L.

Domestic Volvo S60L also has rich active and passive safety configurations. The whole system comes standard with urban safety system, front double airbags, front side airbags, side collision protection, front head and neck protection, ASC pre-stabilization control system, dynamic stability control and traction control system, corner stabilization system, uphill auxiliary system and intelligent driver information system.

The 2.0T engine of domestic Volvo S60L is divided into two power versions, both of which are matched with the 6-speed automatic manual transmission. The maximum power of the low-power engine is 180Ps and the maximum torque is 300Nm;. The high-power engine has a maximum power of 213Ps and a maximum torque of 300Nm. In addition, none of the five models listed this time are equipped with all-wheel drive system.

November 9, 2014: Domestic Volvo XC60 went on the market.

Official guide price: 366,900-539,900 yuan.

New car features:Geely’s second domestically produced Volvo model after its acquisition of Volvo features original localization, high-standard workmanship and panoramic skylights as standard.

Volvo’s domestic XC60 basically maintains the appearance of the imported version, only adding the "Volvo Asia Pacific" logo at the tail. Surprisingly, the rim of the domestic XC60 is bigger than the imported version, and the top model is 20 inches, but the body size is exactly the same as the imported version, and the wheelbase of 2774mm has not been lengthened.

In terms of interior, the domestic XC60 also continues the interior layout of the imported version, which is also the center console design biased towards the driver’s seat side. Among them, the classic dashboard, small-size display screen and rich physical buttons have also been continued, especially the humanized air conditioning wind direction adjustment button at the bottom. It is worth mentioning that the domestic XC60 continues the high-level materials and workmanship of the imported version.

The panoramic sunroof is one of the highlights of the domestic XC60 (all standard), and it has gradually become a standard configuration in luxury brand SUV models. For improving the sense of space in the car, the panoramic sunroof is indeed unique.

In terms of power, the domestic XC60 is equipped with 2.0T four-cylinder and five-cylinder engines (T5) and 2.5T engine (T6). The Drive-E 2.0T four-cylinder engine has a maximum power of 180kW(245Ps) and a peak torque of 350Nm. It is equipped with an 8-speed automatic manual transmission and is a predecessor model. The 2.0T five-cylinder engine has a maximum power of 157kW(213Ps) and a peak torque of 300Nm, which is matched with a 6-speed automatic manual transmission and equipped with a full-time four-wheel drive system.

The 2.5T turbocharged inline five-cylinder engine of T6 model has a maximum power of 187kW(254Ps) and a peak torque of 360Nm, which is matched with a 6-speed automatic manual transmission. At the same time, it is equipped with a full-time four-wheel drive system and 4C active adaptive chassis.

April 9, 2015: Geely Borui went public.

Official guide price: 119,800-229,800 yuan.

New car features:After the acquisition of Volvo, Geely Automobile launched the first model, positioned the medium-sized car and the first model of Geely’s third-generation products, which laid the foundation for a brand-new family-style design and made Geely Automobile begin to change.

After completing the acquisition of Volvo and starting to "share technology" for more than two years, the "Geely Borui" developed and built was finally listed on the KC platform extended by the GMC platform of Volvo medium-sized car. The new car has launched a total of seven models with 1.8T, 2.4L and 3.5L engines, and the official guide price is 119.8-229.8 million yuan.

As a new series of medium-sized cars owned by Geely, Borui not only broke the traditional design concept of Geely at that time, but also laid the foundation for the latest family-style design of Geely in the future. Borui’s front face is designed with a "back-weave" front air intake grille, and the headlights on both sides match it with lenses. At the same time, the front bumper is also designed with fashionable willow grille on both sides, and the interior is equipped with circular fog lights.

Geely Borui’s body lines are stretched, and the slip-back design makes it look quite sporty. The length, width and height of the car body are 4956mm/1861mm/1513mm respectively, and the wheelbase is 2850 mm. The tail shape is also very plump. The tail light lines on both sides are connected with the waistline of the car body, and the bottom is the exhaust layout of two sides.

In terms of interior, Geely Borui’s interior design is simple and atmospheric. The center console of the new car is equipped with an 8-inch touch LCD screen, and the bottom is an air conditioning outlet and function buttons. The overall layout is also relatively clear and easy to operate. In addition, the new car is also equipped with orange ambience lights to highlight the luxury atmosphere of this new car.

In terms of configuration, Geely Borui comes standard with ABS+EBD, ESP electronic body stability system, front double airbags, electronic handbrake, automatic parking function, keyless entry, one-button start, dual-zone independent air conditioning and rear air outlet. Functions such as navigation system, seat heating, electric adjustment, 360 panoramic image, rear electric seat, HUD head-up display and adaptive cruise also appear on Geely Borui high-profile models.

In terms of power, Borui is equipped with 1.8T, 2.4L and 3.5L V6 engines, all of which are matched with the 6-speed automatic manual transmission. Among them, the maximum output power of 1.8T turbocharged engine is 163Ps and the peak torque is 250Nm;. The maximum output power of 2.4L naturally aspirated engine is 162Ps and the peak torque is 210Nm;. The maximum output power of the 3.5L V6 engine is 275Ps and the peak torque is 326Nm.

October 2015: NL-3 model was built under NL platform (named: Bo Yue).

NL platform is a platform specially developed by Geely Automobile to build SUVs. The earliest Global Hawk GX7 and long-range SUVs all came from this platform. In 2014, Geely launched a new compact SUV (internal code name NL-3) based on this platform, which is "Bo Yue" listed at the end of March 2016.

Since June 2014, the news of the model code-named Geely NL-3 has been exposed one after another. Until October 16, 2015, Geely officially named it "Bo Yue". The front face of the new car adopts a "back-weaving" style air intake grille similar to that of Geely Borui, the body adopts a hidden D-pillar design, the tail is decorated with chrome, and the taillights are internally equipped with LED light sources.

In terms of interior and configuration, Geely Bo Yue’s interior lines are smooth and elegant, equipped with multi-function steering wheel, center console touch screen, dual-temperature automatic air conditioning, cruise control, one-button start system and other configurations. In addition, the new car is also equipped with Geely’s new generation of in-vehicle information interconnection system, which is compatible with Apple CarPlay system.

In terms of power, Geely Bo Yue is expected to provide three engines: 1.8L, 1.8T and 2.4L The transmission system will match the manual or automatic gearbox, and it will also be equipped with a four-wheel drive system.

March 26th, 2016: Geely Bo Yue went public.

Official guide price: 98,800-157,800 yuan

New car features:The second model of the third generation product is produced in line with Borui, adopts the latest family-style design style, and has two engines of 2.0L and 1.8T

When Geely NL-3 was officially named "Bo Yue", it was officially listed in March 2016. The new car has launched a total of 10 models equipped with 2.0L and 1.8T engines. As Bo Yue belongs to the second model of Geely’s third-generation product (brand return), the first model is the previously released Borui. Therefore, Bo Yue also adopted Geely’s latest family-style design in design, and the rippling front face and personalized front bumper all incorporated the traditional elements of China.

The side of the car body also adopts a simple and fashionable design, and most of the lines are relatively straight. The lower edge of the window, the lower edge of the rear door and the chrome trim on the side all adopt a unified polyline style. The length, width and height of the car body are 4544mm/1831mm/1713mm respectively, and the wheelbase is 2670mm, which is a compact SUV.

The whole visual center of gravity at the rear of the car is high, and the rear windshield adopts inverted trapezoidal design, and the taillights, license plate frame, rear bumper trim and exhaust also adopt similar trapezoidal elements.

In terms of interior and configuration, Bo Yue’s interior also adopts the latest design style and layout. The curve above the center console comes from the lines of the West Lake Arch Bridge. The buttons and LCD screen below are concentrated in the center of the extremely simple decorative board, and the layout of the buttons around the shift lever is very regular. In terms of configuration, one-button lifting of four-door windows, Bluetooth telephone sound output on the driver’s seat, 12V power supply in the rear row and trunk, introducing air-conditioning cold air into the central armrest box and so on.

In terms of technology/safety configuration, Bo Yue is equipped with adaptive cruise, steep descent, front and rear radar systems, electronic handbrake, automatic parking, electronic stability control of car body and automatic headlights.

In terms of power, Bo Yue is equipped with two engines, 2.0L and 1.8T The maximum power of these two engines is 141 horsepower and 184 horsepower respectively. In terms of transmission, both 2.0L and 1.8T manual models are equipped with 6-speed manual transmission, while 1.8T automatic models are equipped with 6-speed automatic transmission. In addition, the four-wheel drive model is also equipped with NexTrac intelligent timely four-wheel drive system provided by Borg Warner.

September 20, 2016: Geely Emgrand GL, code-named FE-5, went public.

Official guide price: 7.88-11.38 million yuan.

New car features:Positioning higher than Emgrand, more refined design, more sporty style, wheelbase increased by 50mm compared with Emgrand, with 1.3T and 1.8L engines.

The FE platform is also a car platform independently developed by Geely Automobile, mainly to build Emgrand cars, but also to build long-term models. After Geely’s earliest low-end models such as King Kong and Freedom Ship were transformed into classic models, Emgrand cars became the main force of Geely, and then after the acquisition of Volvo, with the blessing of new technologies, Emgrand cars also developed stronger.

With the market segmentation, Geely has also developed a boutique car with a higher market positioning than Emgrand based on the FE platform. The internal code of this product is FE-5, and the official map and the name of the car "Emgrand GL" were officially released in June 2016, and then officially went on sale on September 20.

Geely’s brand-new compact sedan, Emgrand GL, launched a total of seven models with 1.3T and 1.8L engines, and there are 8 colors to choose from. The new car also adopts the latest family design, in which the shield-like air intake has a ripple grille inside, and the headlight group has a family of lenses inside and is connected with the front grille. In addition, the front bumper has also adopted a new shape, with "C"-shaped decorative strips on both sides and LED daytime running lights.

The design of the upper and lower double waistlines on the side of the car body brings more agility. The length, width and height of the car body are 4725mm/1802mm/1478mm respectively, and the wheelbase is 2700mm, in which the wheelbase is increased by 50mm compared with the Emgrand model. The tail has also adopted a new design style. The "duckling tail" design on the trunk lid enhances the layering of the tail, and the two sides of the inverted trapezoidal LED taillight are "cut off", which improves the recognition of the shape of the light group.

In terms of interior, Emgrand GL adopts the design of the cockpit surrounded by aviation, and the center console uses soft materials such as metal brushed decorative panels and imitation leather. The seat and door decorative panels also incorporate brown and black two-color color matching, which is matched with the double stitching technology of door panels and other places, creating a good interior texture. At the same time, the interior also incorporates more Chinese elements, such as the arc of the family-style arch bridge at the top of the center console, and the palindrome design at the handle switch in the door.

In terms of power, Emgrand GL is equipped with 1.3T and 1.8L engines, which are matched with 6-speed manual or 6-speed powershift. The maximum power of the engine is 129Ps and 133Ps respectively. In addition, the new car adopts the former McPherson suspension system and the rear torsion beam suspension system.

October 12, 2016: LYNK&CO brand release, Lectra 01 and LYNK concept car debut.

Lectra brand was officially released in Berlin, Germany. LYNK&CO (Chinese name: Link) is a new era high-end brand jointly established by Geely Holding Group, Geely Automobile Group and Volvo Cars. It integrates European technology, European design, global manufacturing and global sales, and is based on the CMA basic module architecture jointly developed by Geely Automobile and Volvo Cars.

LYNK&CO is a combination of two English words. LYNK means connection and interconnection, which represents the cooperative nature of the brand and the future development route of intelligent interconnection. It is expected to join the ranks of future mobile travel service providers. CO has no specific meaning, its meaning is to make the brand name more catchy, thus showing that the new brand is young and full of vitality.

LYNK&CO 01 concept car is positioned as a compact SUV model, which is built by Geely Automobile Gothenburg Modeling Center led by Peter Hobury, vice president of Geely Group, and its overall style is very fashionable. The large mouth air intake grille gives people a very layered feeling. At the same time, the headlight group adopts split design, in which the LED strip daytime running lights are very personalized, while the high beam and low beam lights are hidden on both sides of the grille, which makes the front face of the whole vehicle look more integrated.

In terms of interior, the new car adopts a 10-inch full LCD instrument panel with mechanical instrument combination design, and is equipped with interior atmosphere lights, 10.1-inch touch screen, electronic shift lever and other elements to increase the sense of technology. On the whole, the new car focuses on Nordic style, and the design is simple and fashionable.

In terms of power, the new car will be equipped with 1.5T three-cylinder and 2.0T four-cylinder engines matched with CMA platform, as well as hybrid system and pure electric system. In terms of transmission, it will be matched with a brand-new 7-speed dual-clutch gearbox. In addition, the new car will be equipped with a four-wheel drive system.

LYNK&CO LYNK concept car is a four-door coupe design product, but there is no plan for mass production in the future, it is just an attempt by designers for LYNK&CO brand.

The whole car looks very dynamic. The front face of the new car still uses a large mouth grille design, while the headlight group uses a more simplified LED light source. Compared with LYNK&CO 01 concept car, the new car has more muscular lines. The car body adopts a four-door style that tilts upwards, which looks very individual, and the taillight group adopts an integrated light belt design, which gives people a very fashionable feeling.

In terms of interior, LYNK concept car is even more exaggerated. The steering wheel with more sporty shape is equipped with a full LCD dashboard and a central control LCD screen, which gives people a more futuristic feeling. At the same time, the 2+2 type four seats also look very design-oriented.

December 15th, 2016: Volvo S90 long wheelbase version goes on sale (produced by Daqing factory).

Official guide price: 369,800-551,800 yuan.

New car features:Domestic version, 120mm longer wheelbase, equipped with 2.0T+8AT, and three-seat honorary version can realize in-car office.

Volvo S90′ s long wheelbase version is basically the same as that of imported models. Except the length is lengthened, the design keeps the original Nordic style. The family-style Raytheon Hammer LED headlights will be standard in all departments. At the same time, in order to cater to the preferences of Chinese people, the front bumper of the new car is designed with chrome decoration.

The biggest change of the new car is the body size. The Volvo S90 long wheelbase version has been extended by 120mm on the basis of S90, and all of it has been used to lengthen the wheelbase, which makes the body size of the new car reach 5083mm/1879mm/1450mm, and the wheelbase is increased to 3061mm, which has reached the current domestic standard of long wheelbase luxury medium and large cars.

In terms of interior, the Volvo S90 long wheelbase version continues the simple and fashionable Nordic atmosphere. The steering wheel and center console are the same as the imported version, and the rear space is significantly increased compared with the imported version. Among them, the T8 long wheelbase three-seat honorary edition model attaches great importance to the riding experience of rear passengers, and focuses on the concept of in-car office, canceling the co-pilot seat and providing very large riding space for rear passengers. In addition, the rear of the new car is also equipped with many in-car office facilities, including folding tables and computer stands, creating a luxurious office atmosphere.

In terms of power, the Volvo S90 long wheelbase version will be equipped with a 2.0T four-cylinder engine and provide three power options, all of which are matched with the 8-speed automatic manual transmission. The maximum power of T4 model is 211Ps;; The maximum power of T5 model is 282Ps;; The T8 model is equipped with a hybrid system with a maximum power of 413Ps and a peak torque of 400Nm, but the T8 version will be available in 2017 at the earliest.

April 16th, 2017: LYNK&CO released the Chinese brand name-LECK, LECK 01 released globally.

New car features:The first model of Lectra brand, based on CMA architecture, shows the design aesthetics, brand-new quality assurance service and brand-new sales model of Lectra production car.

CMA architecture

LYNK&CO brand officially announced its Chinese brand name as Lectra, and simultaneously released the first model-Lectra 01 quasi-production car, which is also the first time that the Lectra brand was released in China. The car will be produced in the road and bridge base of Geely Group in the future, and will be listed on November 28, and will enter the European and American markets in 2019.

The Lexus 01 quasi-production car released this time is based on the Lexus 01 concept car released in Berlin last year. The overall appearance design of the new car has not changed much. The large-mouth air intake is expected to be a Lexus family-style design, and the design of the "L-shaped" LED daytime running light inside the split headlights is inspired by the light of the Arctic.

The side of the new car maintains the design style of the previous concept car, and adopts a two-color body design. The black roof and silver decorative strips look very fashionable and unique. The new car is based on CMA (Compact Modular Architecture), and its wheelbase is 2730mm. It is worth mentioning that the CMA architecture is led by Volvo Cars and jointly developed by Geely Automobile and Volvo Cars. In the future, Volvo’s brand-new 40 family models will be born on this platform.

The tail line of the LECK 01 quasi-mass production car is very smooth and layered, and the taillights are also L-shaped, but the internal light group will be slightly adjusted. The shape of the rear bumper echoes that of the front bumper, and it is equipped with two exhaust ports on both sides.

In the interior design part, because the design of the Lectra 01 concept car itself is very close to mass production, the Lectra 01 quasi-mass production car will not bring too many changes, and it looks a little Nordic style and design sense as a whole, and adopts a 10.25-inch full LCD instrument, a 10.2-inch LCD screen, and integrates most functions, thus reducing physical buttons. The compact electronic shift lever is even more unique for the new car.

In terms of configuration, the new car will be equipped with 360 panoramic images, front collision warning, automatic braking, pedestrian recognition, ACC adaptive cruise, blind spot monitoring, reversing side assistance system, etc., and optional services will be provided in the future.

The new car is based on CMA modular architecture jointly developed by Geely and Volvo, so it can provide a variety of power systems, including 1.5T three-cylinder gasoline engine, 2.0T four-cylinder gasoline engine, hybrid system and pure electric system. In terms of transmission, the new car offers three transmissions: 6-speed manual transmission, 6-speed automatic transmission and 7-speed dual clutch transmission. In addition, the new car will be equipped with a four-wheel drive system in the future.

Warranty service:Lectra brand promise, the first model of Lectra 01 to be listed in the future and all models produced afterwards will enjoy lifetime warranty service and free road rescue service, and the traffic generated by the intelligent interconnection system on the new car will be free for life.

Sales channel:Linke gives priority to cooperate with Alibaba and Microsoft for online sales, and faces different markets around the world. This innovative sales model will bring consumers a unique car buying experience.

April 2017 (Shanghai Auto Show): Geely’s new MPV concept car was released.

Geely Automobile officially launched its brand-new MPV concept car at the 2017 Shanghai Auto Show. The new model adopted Geely’s brand-new family design style. A large number of straight lines are used in the whole vehicle, which makes the appearance of the whole vehicle more business and serious, and at the same time, the vertical space inside the vehicle will become more plentiful.

The new MPV concept car adopts a double-door design, and the front and rear doors can be opened at 90 degrees, which is convenient for members in the car to get on and off. At the same time, as a concept car, this car uses a huge central control display inside, which is full of technology.

In terms of interior, the whole vehicle looks simple, the instrument panel is designed with LCD, and a large LCD screen is also designed at the top of the central control. At the same time, the electronic gear is also the first time to appear on Geely models. In terms of seat layout, this model will use the 7-seat layout of "2+2+3", paying attention to the comfort of the second row of passengers.

August 4, 2017: Geely Volvo established two joint ventures.

Geely Holding Group and Volvo Car formally signed an agreement in Geely Hangzhou Bay R&D Center, and the two sides established a technology joint venture company. At the same time, the joint venture company of Lectra Auto was also announced, with Geely Automobile holding 50% shares, Volvo Car holding 30% shares and Geely Holding holding 20% shares.

With the formal establishment of the joint venture company, the two parties jointly develop new energy technologies through mutual authorization, power technology sharing and parts procurement. Volvo’s shareholding is a powerful endorsement of the brand, consolidating the positioning of high-end brands in the new era and helping the globalization process of the brand.

November 28th, 2017: Link 01 went public.

Official guide price: 15.08-19.88 million yuan.

New car features:Lectra’s first model, based on CMA architecture, compact SUV, providing a variety of styles and rich optional accessories.

Lectra 01 is based on the concept car, and adopts the family design style of Lectra. The front face is very unique, and the split headlight design is adopted. The LED daytime running lights raised on both sides of the front of the car are inspired by the light of the North Pole, while the main headlight group also uses all LED light sources, which are integrated with the front grille, which not only expands the horizontal visual effect, but also highlights the personality color, which is very unusual.

The body lines of the Lectra 01 stretch, and the two rising waistlines add vitality, while the D-pillar of the new car shows an obvious downward trend, which looks very fashionable. In terms of body size, its length, width and height are 4512mm/1856mm/1657mm respectively, and its wheelbase is 2734mm, so it is positioned as a compact SUV.

It is worth mentioning that LINK 01 will have four styles of "glamour, style, strength and purity" according to different lifestyles of consumers, and it will provide 12 wheels, 15 steering wheels, 7 colors of "Rainbow nightlight" and colorful decorative pieces to choose from.

The taillight shape is a highlight of the car, which is highly consistent with the concept car. The energy crystal design is adopted inside, and it is integrated with the English LOGO. It looks very exquisite and has high recognition after lighting. In addition, the Jin model also adopts the layout of leakage and exhaust from both sides alone, which further highlights the sporty temperament (other models are designed with hidden exhaust).

As for the interior, the Lectra 01 adopts the design that the center console is biased to the driver’s side. The large-size central control panel, control knob and control buttons are all concentrated in the central area, and the surrounding areas are wrapped in soft materials, which has significantly improved the texture.

In terms of configuration, the Lectra 01 is equipped with 10.25-inch full LCD instrument, three-spoke multi-function steering wheel, panoramic sunroof, electronic gear lever, CarPlay, CarLife, AQS air quality control system, active cabin cleaning function, dual-temperature automatic air conditioning, automatic parking, electronic handbrake, Start&Stop intelligent start-stop system, rear reversing radar, vehicle theft warning/tracking, starting restriction of stolen vehicles, pedestrians.

In terms of power system, LEEK 01 will be equipped with a VEP4 2.0T turbocharged engine from the Drive-E series, with a maximum power of 190 HP (140kW) and a peak torque of 300 Nm. Two-wheel drive and four-wheel drive models are available for selection, and the acceleration time of 0-100km/h is 7.7 seconds and 7.9 seconds respectively. In the future, the car will also launch a 1.5T three-cylinder engine with a maximum power of 179HP (132kW). In terms of transmission, the new car will match the 6-speed automatic and 7-speed dual-clutch gearboxes. In addition, on the chassis, the chassis flatness of the new car is very high, and the former McPherson plus the rear multi-link independent suspension combination is adopted.

December 20, 2017: A new generation of Volvo XC60 goes on sale.

Official guide price: 369,900-609,900 yuan.

New car features:The vehicle model is updated, the latest family design is adopted, the size is increased compared with the previous generation, the wheelbase is lengthened by 91mm, and the upgraded City Safety urban safety system is equipped.

Volvo’s new generation XC60 has launched a total of eight models with T4, T5 and T8 power. The whole vehicle design adopts the latest design language of Volvo family, the iconic Raytheon Hammer LED headlight group, and the large-size straight waterfall air intake grille shape, while the polygonal air intake shape and brand-new front bumper style under the front of the car are also more fashionable.

The side of the car body has a more three-dimensional design for the waist line, and the size is consistent with the overseas version, with the length, width and height of 4688mm/1902mm/1658mm and the wheelbase of 2865mm respectively. Compared with the previous generation, the length, width and wheelbase have all increased, and the wheelbase has been lengthened by 91mm. The rear of the car is highly similar to the V90, among which the latest Viking Tomahawk taillights are the most eye-catching and greatly enhance the recognition.

In terms of interior, the new generation XC60 has adopted a brand-new Nordic design style, and its overall interior layout is simple and clear, with large-area soft package materials and the use of wood decorative boards. The central control area is equipped with a three-spoke multi-function steering wheel, a full LCD instrument panel and a 9-inch touch screen. The air conditioning outlet originally located under the LCD screen was changed to a vertical outlet style, and it was placed on both sides of the LCD screen with a small number of control buttons.

In terms of configuration, the new car will provide 12.3-inch digital instrument panel, HUD head-up display system, active LED headlights, steering assist lights, 360-degree panoramic image, panoramic sunroof, B&W audio and indoor air quality control system according to different models in the future. In terms of safety configuration, the new car will be equipped with emergency avoidance assistance system, upgraded City Safety urban safety system (working range 4-200km/h) and lane departure assistance system.

In terms of power, the new generation XC60 provides three power levels: T4, T5 and T8, which are all matched with 8AT transmission. The engines correspond to 3 types: 2.0T single supercharged low power, 2.0T single supercharged high power and 2.0T double supercharged plug-in hybrid, with the maximum power of 190Ps, 254Ps and 407Ps respectively. Among them, the T4 model is front-wheel drive, and the other models are all four-wheel drive.

June 28, 2018: Link 02 went public.

Official guide price: 122,800-192,800 yuan.

New car features:Lectra’s second model, based on CMA architecture, crossover SUV, two personality styles, with 1.5T and 2.0T engines.

As the second brand-new model of Lectra, Lectra 02, like the first model Lectra 01, was born on CMA platform. The new car also adopts the family-style design style of Lectra, which is officially called "urban opposition aesthetics", especially its split headlight group. This iconic design has become one of the most important identification elements of Lectra brand. In addition, Linke 02 is also divided into several different design styles, and there are individual differences in details.

Lingke 02 is positioned as a crossover SUV, and its coupe style on the side of the car body is more fashionable and sporty, with the length, width and height of 4448mm/1890mm/1528mm and the wheelbase of 2702mm respectively, which belongs to a large compact SUV. Compared with the Lectra 01, the rear shape is flatter, and the overall style is more dynamic, and the internal structure of the taillight group is also more layered and recognizable.

In terms of interior, LECK 02 also continues the interior design and layout of LECK 01. Among them, the center console is designed to the driver’s side, but the air conditioning outlet, interior decoration cover and materials have been fine-tuned, and the visual presentation should be younger and more sporty. At the same time, the 10.25-inch central control panel integrated car system has also been upgraded and optimized on the Lectra 02, and a "classic" display theme has been added.

In terms of power, the Lectra 02 is equipped with a 1.5T inline three-cylinder engine jointly developed by Geely and Volvo, and a 2.0T four-cylinder turbocharged engine on the Volvo T4 model. The 1.5T three-cylinder engine has two versions with maximum power of 115kW(156Ps) and 132kW(180Ps), and the corresponding peak torques are 245Nm and 265Nm, respectively, which are matched with 6-speed manual and 7-speed powershift.

The 2.0T four-cylinder engine has a maximum power of 140kW(190Ps) and a peak torque of 300Nm, in which the two-wheel drive model matches the 6-speed automatic manual transmission, while the four-wheel drive model matches the 7-speed powershift. In addition, the four-wheel drive model also has four driving modes: economy, comfort, sports and off-road.

April 2018 (Beijing Auto Show): The Geely concept icon concept car was released.

At the 2018 Beijing Auto Show, Geely Automobile was listed at the 2018 Beijing Auto Show and officially released a brand-new concept icon concept car, which is a compact SUV model. Its brand-new and bold shape indicates the design direction and trend of Geely brand SUV models in the future.

The concept icon concept car is very avant-garde in shape and detail design, in which the front grille is a slender line and connected with the front LED daytime running lights. Under the front grille, the long air intake grille makes the new car look full of momentum. On both sides of the grille are LED headlights. Overall, the new car is more square.

The side of the car body is tough and individual, and the overall size is visually larger. The roof also adopts the popular suspended roof. The tail part adopts taillights arranged horizontally, which can echo the front face. The lower bumper adopts rectangular lines, and reflectors are designed on both sides.

In terms of interior and power, the new car is also very sci-fi. The central control part adopts a square steering wheel and a large-size multimedia screen, and the overall design is relatively simple. Power is expected to be equipped with a 1.5T turbocharged engine and a 1.5T engine +48V micro-mixing system, which is matched with the 7-speed powershift.

June 7, 2018: Volvo S90 E hybrid launch (PHEV model)

Official guide price: 1.088 million yuan

New car features:S90′ s top model is available in three-and four-seat versions, and the three-seat version eliminates the co-pilot seat, which can realize the office in the car and the fuel consumption per 100 kilometers is 2.3L

After the T5 model of domestic Volvo S90L goes on the market, the T8 plug-in hybrid version equipped with E-drive hybrid will not go on sale until 2018. Among them, the T8 Honorary Edition has launched two models, the three-seat version and the four-seat version, and the official guide price is 1.088 million yuan.

Volvo S90 T8 Three-Seat Honor Edition (Excellence) is a domestic long-wheelbase version, and its appearance does not have much exclusive design compared with S90 currently on sale. However, there is a hole in the interior of the car. In order to provide a more comfortable ride experience for the rear passengers, the car cancels the co-pilot seat and is equipped with many office facilities in the car, including folding tables and laptop brackets, creating a luxurious office style.

In terms of configuration, as a top model, it has many configurations on S90, such as City Safety Urban Safety Department, Intellisafe Driver Assistance, Intellisafe All-round Safety System, driver’s knee airbag, Orrefors crystal shift lever, front/rear seat heating, front/rear seat ventilation and massage, and Bowers & Wilkin sound system.

In terms of power, the S90 T8 model is equipped with a plug-in hybrid system consisting of a 2.0T dual-supercharged engine and an electric motor, which is matched with an 8-speed automatic manual transmission, and is also equipped with an intelligent four-wheel drive system. Among them, the comprehensive maximum power of this hybrid system is 300kW(408Ps), the comprehensive peak torque is 640Nm, and the comprehensive fuel consumption of 100 kilometers is 2.3L.

July 2018: Geely released a new BMA modular architecture.

The full name of BMA architecture is B-segment Modular Architecture, which is the latest basic modular architecture completely independently developed and designed by Geely in four years and conforms to international technical standards. Highly flexible and extensible, BMA architecture can cover SUV, car, CROSS model, wagon and MPV, and it is a modular architecture tailored for A0 to A+ models.

The difference between BMA architecture and CMA architecture is that the BMA architecture is completely independently developed and designed by Geely, but it also draws on the experience of developing CMA architecture in cooperation with Volvo in the past. The wheelbase expansion range of CMA architecture is 2650mm-2800mm, which is mainly compact (A-class, A+ class) and medium-sized car (B-class); The BMA architecture covers a wheelbase of 2550mm-2700mm, which is used for small (A0 class) and compact (A class).

Features and advantages of BMA architecture:

BMA architecture is highly flexible and extensible, which makes up for the vacancy of CMA architecture for A0 and A-class vehicles.

BMA architecture is a good hand to build the driving space in the car, which can guarantee the largest riding space in the same class;

BMA architecture pays more attention to safety, with the application of high-strength steel for car body exceeding 70% and hot-formed steel exceeding 20%;

BMA architecture has taken the lead in realizing the industry-leading L2 autopilot function, and more advanced technology configurations and technologies;

BMA architecture greatly improves the quality and efficiency, which can reduce the cost and make the price of the car more affordable.

BMA architecture can take into account more models, and the power system can also carry 1.0T, 1.4T and 1.5T engines and new energy power such as PHEV, HEV and 48V MHEV. In addition, in the future, BMA architecture will gradually replace the original B-class platform KC, SUV platform NL, A-class platform FE and MPV exclusive platform of Geely Automobile.

July 27, 2018: Link 01 PHEV went on the market.

Official guide price: 192,700-222,700 yuan

New car features:Lectra’s first new energy vehicle, a new energy vehicle based on fuel vehicle upgrade, a 1.5T plug-in hybrid, and a fuel consumption of 1.7L per 100 kilometers.

Lectra 01 PHEV is the first new energy vehicle owned by Lectra. Because it is upgraded based on the fuel version, it is also built on the CMA modular platform, and it is basically the same as the fuel vehicle in appearance and interior design, but the details are fine-tuned. The LEICK 01 PHEV not only allowed LEICK brand to enter the new energy market, but also announced LEICK’s more powerful service system in the new energy field.

The biggest difference between Lectra 01 PHEV and Lectra 01 is that the left front fender of Lectra 01 PHEV is designed with a charging interface, but its shape is not abrupt, which does not break the sense of coordination of the car. At the same time, the "PHEV" logo was added at the rear of the car. In the interior, a PHEV nameplate is added to the silver decorative strip above the glove box, and all the leather stitches in the car are also designed in blue, thus highlighting the unique charm of new energy.

In terms of power, the Lectra 01 PHEV is equipped with a plug-in hybrid system with CMA architecture, which is a driving mode composed of a 1.5T inline three-cylinder engine and motor. Among them, the comprehensive maximum power of the system is 256Ps, and the capacity of the power battery is 9kWh. The comprehensive maximum cruising range of the new car can reach 992km, the pure electric cruising range is 51km, and the acceleration time of 0-100km/h is 7.3s, and the comprehensive fuel consumption is 1.7L L.

August 30, 2018: Geely Binrui went public.

Official guide price: 79,800-11,080 yuan

New car features:The first car product under BMA framework, entry compact car, 1.0T and 1.4T engines.

After developing a brand-new BMA platform, Geely also developed the first car and SUV based on this platform, in which the internal code of the car is A06 and it is positioned as a compact car. The first preview was exposed on May 24th, 2018. Then it went on sale at the end of August, and launched a total of 7 models equipped with 1.0T and 1.4T engines. The official guide price was 7.98-11.08 million yuan.

Geely Binrui is also Geely’s latest family-style design style, in which the front face is a family-style ripple grille, which is integrated with the headlights on both sides, and the top model is equipped with a full LED light group. The shape of the front enclosure is also quite sporty, and the large black grille creates the visual effect of the sports car.

The side of the car body adopts a strong sporty design, thanks to the sharp waistline and the slip-back roof line. The length, width and height of the car body are slightly 4680mm/1785mm/1460mm, and the wheelbase is 2670 mm. It is a standard compact car with a size between Emgrand and Emgrand GL.

In terms of interior and configuration, Binrui adopted the latest family-style design. It is equipped with keyless entry/one-button start, exterior rearview mirror heating, 10.25-inch central control panel, automatic air conditioning, PM2.5 monitoring and purification system, electric heating of front seats, wireless charging of mobile phones, car body stability control, tire temperature and tire pressure monitoring, electronic handbrake with automatic parking, intelligent far and near light control, automatic emergency rescue E-CALL, pre-collision system with pedestrian identification function, etc.

In terms of power, Binrui is equipped with two turbocharged engines, 1.0T and 1.4T T. Among them, the 1.0T in-cylinder direct injection engine has a maximum power of 100kW(136Ps) and a maximum torque of 205N·m, which is matched with the 6-speed DCT transmission of Gertrak 2.0 generation, and the fuel consumption per 100 kilometers is 4.9L. The 1.4T engine is matched with Bang Qi 8-CVT transmission, with maximum power of 98kW(133Ps), maximum torque of 215N·m and fuel consumption of 5.7L per 100 kilometers.

October 19, 2018: Link 03 went public.

Official guide price: 116,800-166,800 yuan.

New car features:Lectra’s first car, built on CMA architecture and equipped with 1.5T and 2.0T engines, became the sales growth point of Lectra in 2019.

As the first car of the Lectra brand, Lectra 03 also placed great hopes on it. At the same time, in order to strengthen the sports genes of this car, it chose to hold a listing conference at the track at the foot of Mount Fuji in Japan on October 19, 2018. Subsequently, the Lectra 03 did live up to expectations. In 2019, the sales volume reached about 50,000 vehicles, and it became the sales responsibility of the Lectra family at the end of 2019.

Link 03 is listed on the track at the foot of Mount Fuji in Japan.

When the Lectra 03 was launched in 2018, only six models with 1.5T engines were launched, and then two 2.0T models were added at the 2019 Shanghai Auto Show, which laid the foundation for the 03+ performance cars to be launched later and for participating in the WTCR RV World Cup and winning the championship.

Lingke 03 also continues the family-style design language on Lingke 01 and Lingke 02, because it is a car product, so the whole is more avant-garde, novel and bold. In particular, the family’s double-layer front face design has become more coordinated, and the split headlights and the upper LED daytime running lights are still personalized.

From the side of the car body, the center of gravity is very low, and the tough lines outline the sense of force. At the same time, the silver chrome trim from the A-pillar along the roof to the rear windshield side also breaks the specific point. The length, width and height of the car body are 4639mm/1840mm/1460mm, respectively, and the wheelbase is 2730mm, which belongs to a large compact car. In addition to the family taillights, the rear tail, the huge dynamic enclosure at the bottom and the diffuser all show a full sense of movement.

In terms of interior, LECK 03 completely continues the interior design and layout of LECK 02, and the materials and workmanship are equally advanced and exquisite. The integration of the 10.2-inch central control panel and the center console is very good, and it leans to the driver’s side, and also provides more practical physical buttons. In order to strengthen the sense of movement, a seat with integrated headrest and backrest is also adopted, which also has good wrapping.

In terms of power, the Lectra 03 is equipped with two turbocharged engines, 1.5T three-cylinder and 2.0T four-cylinder. The 1.5T three-cylinder engine is divided into high and low power versions, and matched with 6-speed manual and 7-speed powershift. The maximum power of the engine is 115kW(156Ps) and 132kW(180Ps) respectively, and the peak torque ratio is 245Nm and 265Nm.

The 2.0T four-cylinder engine has a maximum power of 140kW(190Ps) and a peak torque of 300Nm, and only matches the 6-speed automatic manual transmission. Lectra 03 are all front-wheel drive models, and are equipped with front McPherson and rear multi-link independent suspension systems.

October 31, 2018: Geely Binyue went public.

Official guide price: 7.88-11.88 million yuan

New car features:The first SUV under the BMA platform, positioned as a high-end small SUV, provides a sports version, has a more dynamic shape, takes 1.0T and 1.5T three-cylinder engines, and adds 1.4T four-cylinder models this year.

After developing a brand-new BMA platform, Geely also developed the first car and SUV based on this platform. The internal code of SUV is SX11, and it is positioned as a small SUV. The first news exposure was in April 2018, and then the official name of "Binyue" was announced in August, and the official map of the sports version was announced.

In the end of October, it was officially launched for sale, and a total of five models equipped with two three-cylinder engines, 1.0T and 1.5T, were launched. The official guide price was 7.88-118,800 yuan. Subsequently, in early November, a new model, 260T 7DCT Ranger, was put on the market for 108,800 yuan. In June 2019. The light mixed version of MHEV has also been listed one after another, selling for 129,800 yuan. In addition, at the beginning of 2020, the declaration map of the new 1.4T four-cylinder engine model was also exposed.

Binyue is a brand-new small SUV launched by Geely Automobile. The new car is based on BMA architecture and focuses on young consumers. Different from Geely’s small SUV before, Binyue not only has a more sense of design, but also gives people a more advanced overall appearance. It is no longer just an entry-level SUV, but its positioning is higher.

In addition to the family-style mid-net shape, Binyue’s front enclosure shape is not the same as the previous Geely SUV. The length, width and height of the car body are 4330mm/1800mm/1609mm respectively, and the wheelbase is 2600mm, which is relatively large in a small SUV. The rear shape of the sports version is more exaggerated, especially the spoiler at the top and the exhaust from both sides.

In terms of interior and configuration, Binyue adopted a simple interior design and layout without losing the sense of technology, and the interior materials also had better performance than the same level. The center console used soft materials and was decorated with brushed aluminum panels. The central control panel integrates the latest GKUI intelligent ecosystem and T-BOX remote control system, and is also equipped with ICC intelligent navigation system, APA automatic parking, AEB city pre-collision system, AEB-P pedestrian identification and protection system, panoramic image, LDW lane departure warning, BSD blind spot monitoring, etc.

In terms of power, Binyue is equipped with two three-cylinder turbocharged engines, 1.0T and 1.5t.. Among them, the 1.0T engine has a maximum power of 100kW(136Ps) and a peak torque of 205Nm, and is only equipped with a 6-speed manual transmission. The maximum power of 1.5T engine is 130kW(177Ps), and the peak torque is 255Nm, which matches the 7-speed powershift.

In addition, the new model to be launched this year is equipped with a 1.4T four-cylinder turbocharged engine with model JLB-4G14TB, with a maximum power of 141Ps.

March 11, 2019: Geely Jiaji went public.

Official guide price: 998-215,800 yuan.

New car features:MPV, latest family design, fuel/hybrid/plug-in models, 6-seat and 7-seat layouts, and 7-seat layouts.

Geely Jiaji is the final production version of the new MPV concept car released at the 2017 Shanghai Auto Show. When the new car went on the market, a total of 11 models equipped with 1.5T, 1.8T turbocharged, 1.5T+48V light hybrid and 1.5T plug-in hybrid were launched, including new energy vehicles of PHEV, and the official guide price was 9.98-215,800 yuan.

As the MPV model of Geely Automobile, Jiaji also adopts the latest family design concept of Geely, and the front grille of Xinghe palindrome matches the ribs on the engine compartment cover to create a more fierce front face shape. The headlight group is angular, supplemented by four light arc LED daytime running lights, and the visual effect is dynamic and sharp.

The body lines are very smooth and the shape is stable and atmospheric. The straight waistline extends backwards from the front of the front door to the top of the taillight group. At the same time, it also adopts a suspended roof, and chrome trim is also matched at the top and bottom. The rear of the car is focused on a triangular taillight group, and the internal light source is composed of a plurality of LED strip. The plug-in hybrid version adds a PHEV exclusive logo to the front fender, and adds a charging interface on the left side, while the fuel filler is on the right side.

For the interior, Geely Jiaji center console adopts the embracing design named Full-Vison, and is equipped with a three-spoke multi-function steering wheel, a 12.3-inch floating central control LCD screen and 72-color streamer atmosphere lights. In addition, the new car also provides three seat layouts: 6 seats of "2+2+2", 7 seats of "2+2+3" and "2+3+2".

In terms of power, Geely Jiaji provides three power models: 1.5TD+48V light hybrid, 1.5TD plug-in hybrid and 1.8TD. Among them, the 1.5TD+48V light-mixed vehicle has a maximum power of 140kW(190Ps) and a maximum torque of 300Nm, which is matched with the wet 7-speed powershift, and its comprehensive fuel consumption is 5.9L.

The PHEV plug-in hybrid vehicle is equipped with a plug-in hybrid system consisting of a 1.5TD engine, an electric motor and a ternary lithium battery pack with a capacity of 11.3kWh, which is also matched with the 7-speed wet powershift. The comprehensive maximum power of this system is 258Ps, the peak torque is 385Nm, and the comprehensive fuel consumption is 1.6L/100km. The fuel model is equipped with a 1.8TD turbocharged engine with a maximum power of 135kW(184Ps) and a peak torque of 300 Nm, which is matched with a 6-speed automatic manual transmission.

May 10, 2019: Geely Xingyue went public.

Official guide price: 135,800-216,800 yuan.

New car features:Based on CMA architecture, the first coupe SUV, more dynamic design style, normal version and sports version, and fuel+new energy vehicle.

Under the CMA platform, Geely also developed the first brand-new sports coupe SUV with internal code name FY11. In mid-October 2018, it released the declaration map of the car, and then in 2019, the information of sports models was exposed one after another. Then on February 22, it also announced "Xingyue", which was officially listed on May 10, and launched 11 models, covering the fuel version.

The name "Xingyue" comes from an asteroid in the main belt whose orbit lies between Mars and Jupiter. This asteroid was officially discovered by the astronomical team under Geely at Lijiang Observatory of Yunnan Observatory of Chinese Academy of Sciences, and has passed the certification of the International Astronomical Union (IAU). Geely gave the name of asteroid to the new car, which also implied a never-ending spirit of exploration.

Geely Xingyue offers two exterior styles, namely "normal version" and "sports version", both of which adopt the body design of coupe SUV. Among them, the medium net with ripple shape is flatter than other SUVs, and the high-profile models are also equipped with matrix LED headlights with adaptive function from Valeo.

The coupe design is the biggest feature and highlight of the side of the car body, and the drag coefficient of the whole car is as low as 0.325Cd. The length, width and height of the car body are 4605mm/1878mm/1643mm respectively, and the wheelbase is 2700mm, which belongs to a large compact SUV. The rear of the car is full and layered, and the sports version is also equipped with a layout of four outlets on both sides, while the regular version is a layout of two outlets on both sides.

As for the interior, the overall instrument panel of Xingyue adopts asymmetric design, and the embedded large-size central control panel is slightly inclined to the driver’s seat, and is connected with the instrument panel through irregular decorative strips, showing a unique visual effect of connecting screens. The center console in front of the co-pilot adopts a patchwork laminated design, with black painted decorative boards and chrome-plated elements intertwined, and the shape is three-dimensional and avant-garde.

In terms of configuration, Geely Xingyue will be equipped with AGS intelligent variable air intake grille, Borgwarner timely four-wheel drive system, DP-EPS electronic steering, and provide ejection mode, thus enhancing the driving passion of more consumers, and shifting paddles with five driving modes such as sports, snow and off-road, which will provide users with a more interesting sports driving experience.

In terms of power, Xingyue provides the power of 2.0T fuel, 1.5T+48V micro-hybrid and 1.5T+ plug-in hybrid motor. The fuel version of the 2.0T engine has a maximum power of 175kW(238Ps) and a peak torque of 350Nm, which is matched with the 8-speed automatic manual transmission. The 1.5T engine of 48V micro-hybrid (MHEV) vehicle has a maximum power of 130kW(177Ps) and a peak torque of 255Nm, which matches the 7-speed powershift.

The plug-in hybrid version (PHEV) is equipped with a hybrid system consisting of 1.5T engine and motor components, which matches the 7-speed powershift. The maximum comprehensive power of this hybrid system is 190kW(180Ps) and the comprehensive peak torque is 415Nm. The cruising range of 56km and 80km can be achieved in pure electric mode, and the comprehensive fuel consumption per 100 km is 1.6L and 1.2L respectively.

May 24th, 2019: Volvo XC40 goes on the market.

Official guide price: 264,800-385,800 yuan.

New car features:Compact SUV, based on CMA architecture, with the same size as the imported version, providing three power levels, and equipped with City Safety urban safety system.

The domestic Volvo XC40 is a brand-new luxury compact SUV based on CMA architecture, and has launched a total of seven models with three kinds of power. The new car continues the appearance of imported models and remains a simple Nordic style. Polygonal front grille, Raytheon hammer daytime running lights and L-shaped taillights are Volvo’s new family designs.

It is worth mentioning that the body size of the domestic version of XC40 is exactly the same as that of the imported version, with the same length, width and height of 4425mm/1863mm/1652mm and the wheelbase of 2702mm.

In terms of interior, the domestic version of XC40 also adopts a relatively simple interior design, and continues the configuration of some imported models. Such as 12.3-inch full LCD instrument panel, panoramic sunroof, keyless entry, one-button start, etc. For Volvo, the advanced driver assistance system will not be absent, and the City Safety urban safety system can also improve the active safety of this car and reduce the driver’s pressure.

In terms of power, the domestic version of XC40 provides T3, T4 and T5 power levels, all of which are matched with the 8-speed automatic manual transmission, and there are two-wheel drive and four-wheel drive models to choose from. The T3 model is equipped with a 1.5T three-cylinder engine, with a maximum power of 163Ps and a peak torque of 265Nm.

The T4 model is equipped with a 2.0T engine with low power adjustment, with a maximum power of 190Ps and a peak torque of 300Nm;. The most powerful T5 model is equipped with a 2.0T engine with high power adjustment, with a maximum power of 252Ps and a peak torque of 350Nm.

September 5, 2019: Linke 02 PHEV and Linke 03 PHEV were listed.

Subsidized price: Linke 02 PHEV sells for 16.97-19.97 million yuan; Lingke 03 PHEV sells for 16.87-19.87 million yuan.

New car features:New energy vehicle based on fuel vehicle upgrade, featuring 1.5T plug-in hybrid, 1.7L fuel consumption per 100 kilometers, and providing rich optional configuration.

After the launch of the LEEK 01 PHEV plug-in hybrid vehicle, in order to expand LEEK’s models in the field of new energy vehicles, LEEK 02 and LEEK 03 PHEV models were also launched simultaneously at the Chengdu Auto Show in 2019. Among them, there are 3 models of LEICK 02 PHEV, and the price after comprehensive subsidy is 16.97-19.97 million yuan; There are 3 models of LEICK 03 PHEV, and the price after comprehensive subsidy is 16.87-19.87 million yuan.

Because the PHEV models of Lectra are all upgraded based on the fuel version, they are also born in CMA architecture, and the shape, interior and detail design are consistent with those of fuel vehicles. The difference is that PHEV can provide more optional configurations.

Lectra 02 PHEV and Lectra 03 PHEV both provide a variety of wheel hub styles, exterior rearview mirror camera, side window/rear windshield green glass, ACC adaptive cruise, front parking camera and radar, two-color body, sunroof, front and rear surrounding decorative panels, side surrounding decorative panels and other optional accessories.

In terms of power, both the Lectra 02 PHEV and the Lectra 03 PHEV are equipped with a plug-in hybrid system consisting of a 1.5T engine and a battery, in which the maximum power of the engine is 179Ps, the combined maximum power of the system is 256Ps and the capacity of the power battery is 9kWh. The combined maximum cruising range of these two models can reach 992km, and the pure electric cruising range is 51km. In addition, the acceleration time per 100 kilometers of the Lectra 03 PHEV is 7.3s, and the comprehensive fuel consumption is 1.7L.

December 6, 2019: Link 05 was released.

New car features:Lectra’s second coupe SUV, based on CMA architecture, with more sporty details, provides high-performance models.

On December 5th, 2019, LECK officially launched its brand-new model-LECK 05 in China. This is a cross-border compact SUV that combines Coupe and SUV design elements, and it is also based on CMA architecture. At the same time, it will shoulder the heavy responsibility of the sales growth of Lectra with the subsequent launch of Lectra 06.

Link 05 also continues the family-style aesthetic design concept of urban opposition, and has made breakthroughs and changes in details. Among them, the penetrating air intake grille plays a visual effect of further stretching the width of the front of the car, and the headlights are still in a split shape. The design of the internal "L-shaped" LED daytime running lights is inspired by the light of the Arctic.

The design style of the coupe is the biggest feature of the Lexus 05. At the same time, in order to reduce the heavy feeling of SUV models, the roof is also designed in a suspended manner, and the C-pillar part is designed with diversion details. The length, width and height of the car body are 4592mm/1879mm/1628mm respectively, and the wheelbase is 2734 mm.

The visual center of gravity of the rear is in the taillight group, and the inner part creates a sense of concentration through the progressive light group. The outward expansion design on both sides of the bumper is conducive to further increasing the lateral width of the rear vision and reducing the visual center of gravity.

As for the interior, the overall interior of Lectra 05 takes polygons as design elements, focusing on the young style with a sense of science and technology. Like other Lectra models, there is a large central control panel in front of the center console, but the difference is that there are many physical buttons in front of and around the handlebar. In addition, in order to enhance the sense of movement, the new car will be equipped with steering wheel shift paddles, integrated sports seats and four adjustable driving modes.

In terms of power, the Lectra 05 will be equipped with a 1.5T three-cylinder or 2.0T four-cylinder turbocharged engine with maximum power of 180Ps and 190Ps; respectively; At the same time, a plug-in hybrid system (PHEV) with a 1.5T three-cylinder engine will be launched.

The Lectra 05 is also expected to launch a high-performance version like the Lectra 03+, and will be equipped with a 2.0TD high-power engine from Volvo, matched with an 8-speed automatic manual transmission and equipped with a four-wheel Drive-E system. The maximum power of the engine is 254Ps, the peak torque is 350Nm, and the maximum speed can reach 230 km/h.

August 2, 2019: LinkedIn 03+ went public.

Official guide price: 185,800-228,800 yuan.

New car features:Link’s first performance car, the first performance car of China brand, sports kit blessing, 2.0T+8AT+ four-wheel drive, and 100-kilometer acceleration of 5.9s

Lingke participated in WTCR RV World Cup and won the annual championship.

Although the Lectra 03+ is only a performance version of the Lectra 03, it really pioneered the performance car of China brand. Also in 2019, Lectra participated in the WTCR RV World Cup and won the annual championship, becoming the first China brand team to win the annual world championship in international competitions, and also won the championship of Lectra 03 TCR, which made Lectra 03+, a performance car positioned as a "small steel gun", attract the attention of many young people.

As a performance version of the Lectra 03, Lectra 03+ provides a wealth of customized options based on the sporty design scheme of Lectra 03 Jin/Jin Pro, including all-carbon fiber aerodynamic kit (including front lip and side skirt), all-carbon fiber large rear spoiler, 19-inch close-spoke forged wheel rim, panoramic sunroof, front tower top reinforcement connector (top bar) and so on.

It is worth mentioning that, after the optional installation of the aerodynamic kit and the large rear spoiler, the downforce of the Lectra 03+ at the maximum speed is increased from 11kg to 40kg, which greatly improves the handling stability at high speed.

As for the interior, the interior of LECK 03+ also continues the design and layout of LECK 03, but the color scheme of Gao Fancha has brought a stronger visual impact. In addition to the original high-end configuration such as full LCD instrument panel, central control large screen, electronic gear handle and electronic handbrake, Linke 03+ also provides an integrated sports seat with electric adjustment, and a sports cockpit (including steering wheel, door panel, seat, center console, etc.) wrapped in Alcantara material can be installed optionally.

In terms of power, the Lectra 03+ is equipped with Geely JLH-4G20TDC/Volvo B4204T23 2.0T inline four-cylinder engine, which is matched with the 8-speed automatic manual transmission, and is also equipped with Borgwarner intelligent four-wheel drive system. Among them, the engine has a maximum power of 254Ps and a peak torque of 350Nm, and it is mounted on all Volvo T5 power models currently on sale. In terms of performance, the 0-100km/h acceleration time of the Lectra 03+ is 5.9 seconds, while the 100km/h braking distance is 34 m..

November 22, 2019: Linke 01 HEV went on the market.

Official guide price: 182,800 yuan

New car features:Lectra’s first hybrid car, derivative car of 01, more aurora green decoration, 1.5T Miller cycle engine and motor, and fuel consumption of 4.8L

Following the PHEV plug-in hybrid model, Lectra introduced the HEV hybrid model based on 01, which is also a derivative model of 01, enriching the selection of Lectra 01 models. Only one model was launched at the 2019 Guangzhou Auto Show, and the official guide price was 182,800 yuan.

Because it is based on the upgrade of Lectra 01, the shape of Lectra 01 HEV is the same as the fuel version, but the difference is that the body is decorated with brand-new aurora green, which has high recognition. At the same time, the 19-inch rim is also treated with contrast color. The logo of "01 HEV" was also posted on the right side of the rear of the car.

In terms of interior, the Lectra 01 HEV continues the interior design and layout of Lectra 01, and is also equipped with 10.25-inch full LCD instrument, 10.25-inch central control display screen, 360-degree panoramic image system, adaptive cruise, active braking system, blind spot monitoring, Harman Infinity Hi-Fi audio and so on.

In terms of power, the Lectra 01 HEV is equipped with a 1.5T Miller cycle engine, and the battery is in the middle layout, which matches the 7-speed DCT transmission. The comprehensive maximum power of the system is 145kW(197Ps), the peak torque is 355Nm, and the comprehensive fuel consumption per 100 kilometers is 4.8L.

December 12, 2019: The new third-generation Volvo S60 went on sale.

Official guide price: 285,900-461,900 yuan.

New car features:Third-generation vehicle, based on SPA architecture, with two exterior styles, wheelbase of 2872mm, City Safety system as standard, and four power systems.

Sports version model

The third-generation Volvo S60 has launched seven models with different configurations. The official guide price is 28.69-46.19 million yuan, and it provides two exterior styles. The wheelbase is lengthened to 2872mm, and the rear space has also been improved. In addition, the technology configuration and intelligence have also been greatly improved compared with the previous generation models.

The new generation S60 adopts Volvo’s latest family-style design language, in which the three-dimensional and exquisite front grille, the front LED headlight group with Raytheon’s hammer daytime running lights and the three-stage front bumper with distinct layers are the most iconic designs, which not only make the whole vehicle look younger, but also greatly improve the recognition. In addition, S60 will also provide two design styles of "Deluxe Edition" and "Sport Edition" according to different models.

Deluxe model

Among them, the front grille of the "Deluxe Edition" has a straight waterfall design, and a large number of chrome-plated decorations are used in the details. At the same time, there are chrome-plated frames at the periphery of fog lights on both sides of the front bumper to enhance the texture; On the other hand, the interior of the front grille of the "Sports Edition" model is all black, while the area of the air inlets on both sides has been reduced, and chrome trim strips have been cancelled. At the same time, black trim strips have been added to the details of the front bumper to further enhance the sporty atmosphere.

As a replacement model, the body size of the new generation Volvo S60 has also been upgraded, with the length, width and height of 4761mm/1850mm/1437mm and the wheelbase of 2872mm, reaching the mainstream level of luxury medium-sized cars, but still slightly smaller than the long-wheelbase models of German BBA. In addition, the new car will provide six colors to choose from, namely crystal white pearl paint, agate black metallic paint, maple brown metallic paint, cowboy blue metallic paint, sea salt gray metallic paint and lava red metallic paint.

The shape of the rear of the car is also layered and continues Volvo’s design features. The shape of the Raytheon Hammer LED taillight group similar to S90 is the most eye-catching, but the visual center of the whole rear of the car is on the upper side. Together with the chrome-plated scheduling layout with two sides at the bottom, it highlights the sense of movement of the whole car. It is worth mentioning that there is not much difference in the rear design between the luxury version and the sports version. In addition, the new car will also provide 18/18/19 three sizes and five styles of wheels to choose from.

In terms of interior, the new generation S60 also adopts Volvo family-style minimalist design style and layout, which is highly similar to XC60 as a whole. Three of them are multi-functional. Well, the steering wheel, 12.3-inch full LCD instrument panel and 8-inch central control panel highlight the sense of science and technology. At the same time, a large number of soft materials are used inside, which is very good in both visual feeling and touch, and the details are also very exquisite.

In terms of configuration, the new generation S60 is also equipped with electric panoramic sunroof, integrated double-sided exhaust pipes, rain-sensing automatic wiper, AquaBlade spray wiper, Volvo On Call on-board butler (including 3-year service and remote vehicle control) Bluetooth hands-free entertainment system, Apple Carplay system, voice control, Harman Kardon audio, 360-degree panoramic camera, keyless entry and hands-free trunk opening.