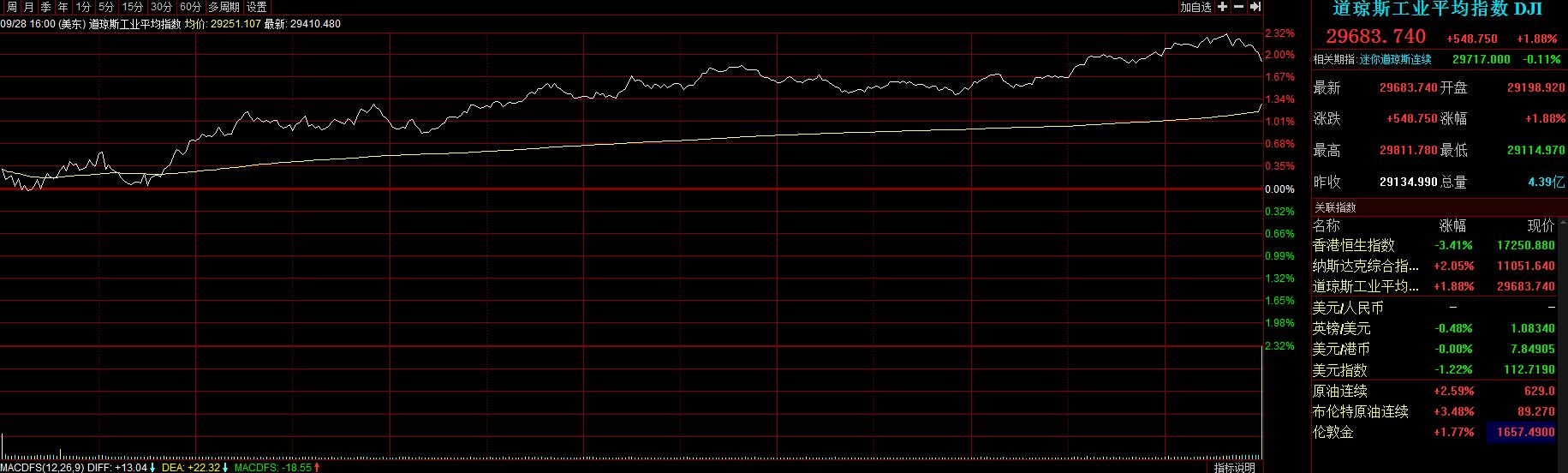

Global News: Feeling Better? The Dow rose more than 500 points and left the bear market temporarily. Four leaks were found in the Beixi pipeline.

On Thursday, local time, US stocks rebounded across the board. The Dow rose more than 500 points to temporarily break away from the bear market, ending a six-day losing streak with the S&P 500 index, and the Nasdaq rose more than 2%. Earlier, the Bank of England’s emergency announcement that it would buy long-term government bonds was regarded as a signal to rescue the market, which boosted investor sentiment.

Anglo-American long-term debt also rose sharply. The yield of 10-year US debt fell by more than 32 basis points from a 12-year high, the deepest decline in 13 years, and the yield of 30-year British debt fell by more than 1 percentage point. After hitting a 20-year high, the US dollar fell by more than 1%, while the British pound fell by 1.8% against the US dollar and then rose by 1.7%. The offshore RMB rose above 7.16 yuan.

David Lefkowitz, head of US equities at UBS, pointed out that the emergency intervention of the Bank of England boosted the rise of US stocks. In the past few trading days, the pressure on the US stock market reflected some turbulence in the fixed income market. As the turmoil subsided, the tone of the stock market showed improvement.

In terms of energy, the Beixi pipeline, which has received much attention, has new news. According to foreign media reports, four leaks were found in Beixi pipeline, instead of the three previously reported.

In terms of individual stocks, while the Nasdaq rose sharply overnight, Apple closed down against the market. Earlier, it was reported that due to weak demand, Apple would give up its plan to increase production of iPhone14, but Guo Ming questioned this, saying that Apple or a new car team would be built this year.

[overnight U.S. stocks]

Among the large Chinese stocks, Alibaba rose 4.01%, Baidu rose 1.79%, Netease rose 0.10% and Pinduoduo rose 3.26%.

Among the large US technology stocks, Apple fell 1.27%, Amazon rose 3.15%, Google A rose 2.62%, and Nye soared 9.29%.

[global index]

[global goods]

The main contract of WTI crude oil closed at $82.09 per barrel, up 4.57%; The main contract of Brent crude oil closed at $89.27 per barrel, up 3.48%; The main contract of crude oil in the previous period closed at 629.00 yuan per barrel overnight, up 2.59%.

Overnight, the Shanghai gold main contract closed up 0.92% to 388.88 yuan per gram; The main contract of Shanghai Bank closed up 1.80% to 4,408.00 yuan per kilogram.

[overnight news]

The Bank of England announced an "unlimited" temporary bond purchase to save the market? Global national debt soared.

On Wednesday, the Bank of England issued a statement saying that it would temporarily purchase long-term British government bonds "at any necessary scale" to restore order in the British bond market. After the announcement, British government bonds soared across the board and the exchange rate of the pound against the US dollar plummeted. Global national debt has also skyrocketed, including the bond markets of Britain, France, Germany, Italy and the United States, and even the debt has stopped falling and rose. Before the Bank of England stepped up its move, the yield of British 30-year government bonds rose to the highest level since 1998, reaching 5.14% at one time. According to the media, the Bank of England quickly reversed its previous "non-intervention" stance on Wednesday because of the huge margin demand faced by pension funds. Investment banks and fund managers have warned the Bank of England in recent days that the demand for margin call may trigger a collapse of the UK bond market.

EU announces eighth round of sanctions against Russia

According to CCTV news, Ursula von der Leyen announced that it will completely ban the sale of Russian goods in the EU market, which will reduce Russia’s income by 7 billion euros; Increase the list of goods, technologies and services prohibited from exporting to Russia; At the same time, the EU will also announce the legal basis for setting a price limit for Russian oil and take measures to punish attempts to evade EU sanctions against Russia. On the same day, the media said that the EU continued to discuss the implementation of a "price cap" on Russian oil and considered adding shipping restrictions to the sanctions against Russian oil. According to the analysis, the "oil price ceiling" is a dangerous gamble.

Senior Fed officials who are dovish say that the progress in fighting high inflation is not clear enough to support a 75 basis point interest rate hike in November.

Bostic, president of Atlanta Fed, said that his benchmark forecast is to increase 75 basis points in November and 50 basis points in December, all depending on future data. He revisited the theory of suspending interest rate hikes, saying that to avoid excessive austerity, we should stop before inflation falls to the target of 2%. He also mentioned that in the face of many geopolitical uncertainties, pay attention to the situation in Britain and other places.

Russia denies creating the "Beixi" pipeline leakage accident, and the EU believes that the accident was caused by sabotage.

Peskov, Russian Presidential Press Secretary, told Russian media on 28th that the so-called Russian involvement in the production of "Beixi -1" and "Beixi -2" natural gas pipeline leakage accidents was "predictable and foolish speculation". Borrell, the European Union’s High Representative for Foreign Affairs and Security Policy, said in a statement on the same day that all information indicated that the accident was caused by sabotage.

When Biden’s cabinet was brewing a reshuffle, US Treasury Secretary Yellen told the White House to stay until after the mid-term elections in November.

According to the media, the White House is preparing for the departure or transfer of Biden’s senior cabinet officials after the mid-term elections in November, and the candidates are evaluated in the fields of economy, diplomacy and domestic policy. What will happen to senior officials such as Yellen may depend on the performance of the Democratic Party in the mid-term elections in November.

[company news]

Guo Ming questioned the rumor that Apple gave up the plan to increase production, and said that Apple will build a new car team this year.

According to media reports, Apple has told suppliers to reduce the production of up to 6 million iPhone 14 series products in the second half of this year. Apple shares closed down against the trend. Guo Ming, a well-known Apple analyst, said it was a bit strange for him that Apple gave up the iPhone to increase production. As his previous survey showed, Apple has plans to switch the production lines of iPhone 14 and Plus to iPhone 14 Pro and Pro Max and reduce the price of iPhone 13, but he has never heard of any plans to increase the production of the whole iPhone. He also said that Apple may establish a new Apple Car team, namely the Apple Car project team, before the end of this year.

Bojian’s share price soared by about 40%, and its drug test results for Alzheimer’s disease were positive.

The share price of Bojian, an American pharmaceutical company, surged 39.85% on Wednesday to close at $276.61 per share. Bojian announced that the third-phase clinical trial of lecanemab, a drug for treating Alzheimer’s disease, developed in cooperation with Japanese pharmaceutical company Eisai, had positive results, which slowed down the cognitive decline of patients with early Alzheimer’s Harmo’s disease by 27% within 18 months, reaching the main goal and all key secondary goals. Although the effect is mild, the result is highly significant.

Bili Bili: Application for conversion to dual major listing on the Hong Kong Stock Exchange

On September 29th, Billie Billie announced on the Hong Kong Stock Exchange that the company’s voluntary change from its second listing position on the Stock Exchange to its main listing will take effect on October 3rd, 2022. At that time, the company will become a dual-listed company on the Stock Exchange and Nasdaq, and the stock mark "S" will be deleted from its stock abbreviation on the effective date.