State-owned assets and Huawei compete for shares in Seme Technology, and the valuation of the leading intelligent driving simulation test has increased by nearly 174 times in four years.

With the rapid penetration of electrification and intelligence, intelligent driving has become one of the main lines of the strategic layout of car companies.

As an important participant in the ICV testing, verification and evaluation solution industry in China, Semir Technology has recently submitted a prospectus to the Hong Kong Stock Exchange, Guangyin International,As a co-sponsor.

According to the prospectus, Semir Technology is a company focusing on simulation technology, mainly engaged in the design and development of simulation test products for intelligent networked vehicles (ICV) and providing relevant testing, verification and evaluation solutions. It independently developed and commercialized the simulation test, verification and evaluation tool chain Sim Pro for ICV, focusing on the testing of automatic driving solutions at L3 and above.

According to Jost Sullivan’s data, Syme Technology is the second largest market participant in terms of revenue in 2022, with a market share of about 5.5%.

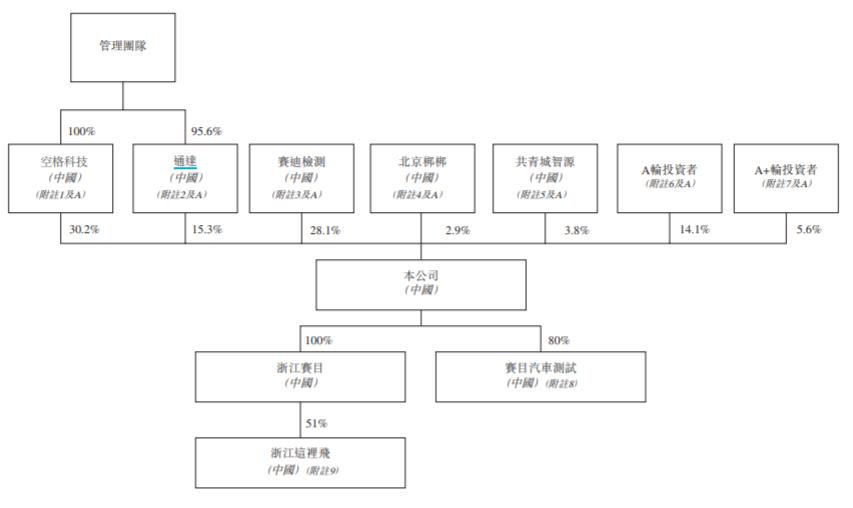

Therefore, Semu Technology has been sought after by capital before it is listed. Before the IPO, Semu Technology mainlyFor Space Technology, CCID Testing, Tongda, Gongqingcheng Zhiyuan, Beijing Bangbang, and Beijing Shunyi, Hubble Technology, Beijing Cornerstone, CITIC Investment, Jingwei Hengrun, Gongqingcheng Junhe,Waiting for A-round and A+ round investors.

Source: prospectus

Among them, CCID Testing and Beijing Shunyi all have state-owned background; Hubble Technology is a venture capital institution wholly owned by Huawei Investment Holdings Limited.

It is worth noting that Semir Technology was originally established by CCID Testing’s parent company CCID Group and Beijing Bangbang, and was originally a state-owned enterprise. Therefore, the changes of the company’s share capital and shareholders over the years have also attracted the attention of China Securities Regulatory Commission.

On December 22, 2023, China Securities Regulatory Commission asked Semu Technology to issue supplementary materials, including employee stock ownership plan, changes in share capital and shareholders, and state-owned assets management procedures.

Source: China Securities Regulatory Commission

A big customer like water

According to a survey conducted by Time Weekly, the revenue of Semu Technology relies heavily on big customers.

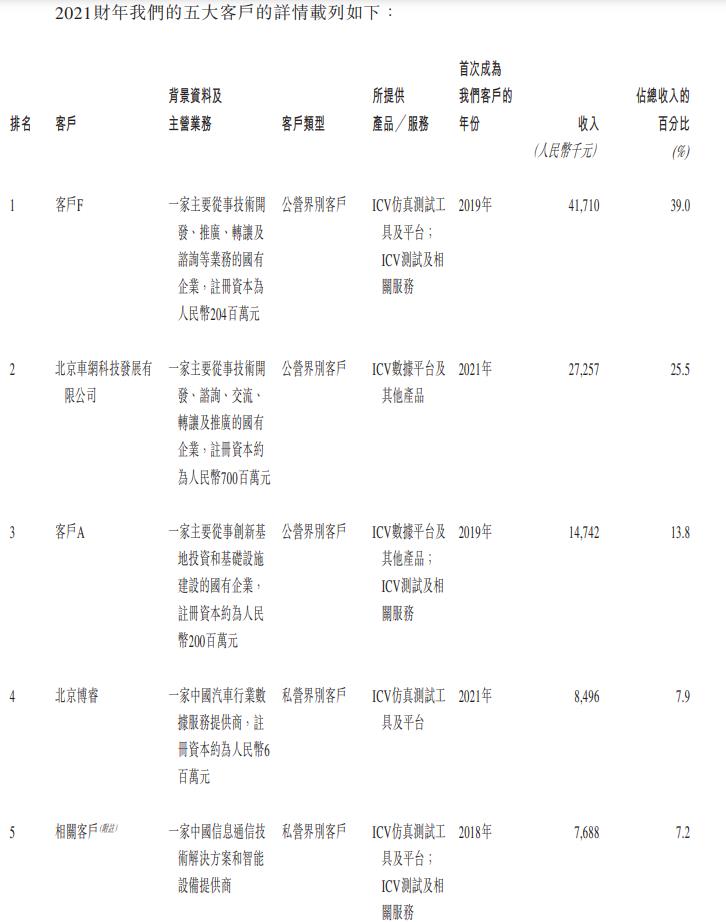

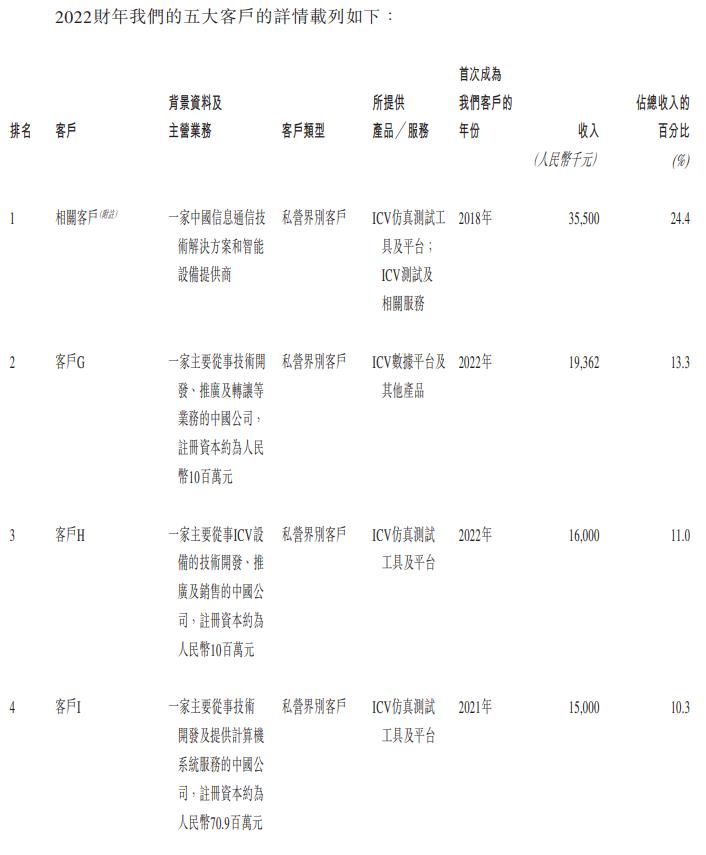

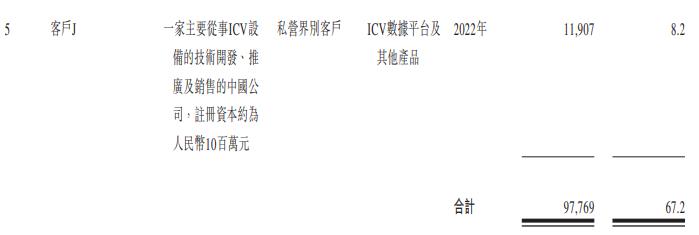

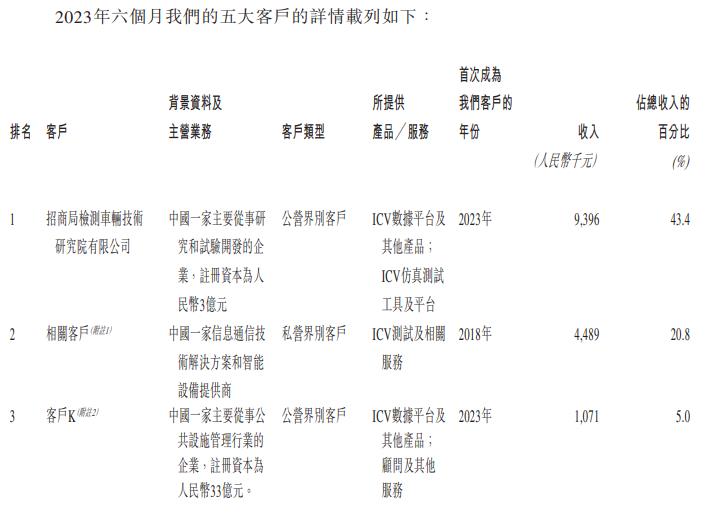

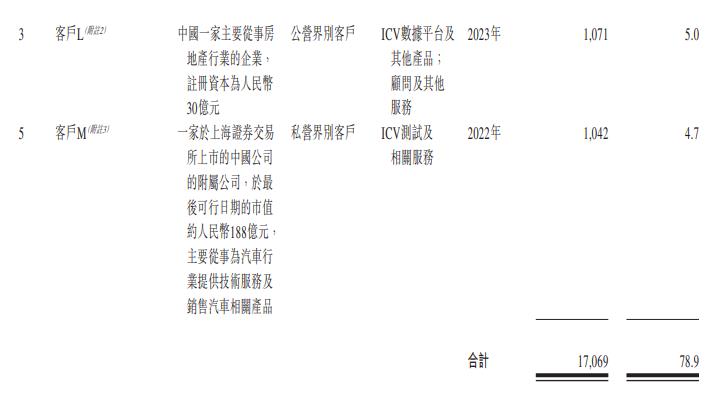

In 2020 -2022 and the first half of 2023, the revenue from the top five customers of Semir Technology accounted for 100.0%, 93.4%, 67.2% and 78.9% of the total revenue respectively, among which the revenue from the largest customer accounted for about 58.7%, 39.0%, 24.4% and 43.4% of the total revenue respectively.

But the core customers of Semir Technology have been changing.

According to the disclosure in the prospectus, in 2020, the revenue of Semu Technology from customer A and customer B was 41.768 million yuan and 26.549 million yuan respectively, accounting for 58.7% and 37.3% of the total revenue respectively.

By 2021, customer F and Beijing Chewang Technology Development Co., Ltd. (hereinafter referred to as "Beijing Chewang") will become the top two customers of Semir Technology. The company’s income from customer F and Beijing Auto Network is 41.71 million yuan and 27.257 million yuan respectively, accounting for 39% and 25.5% of the total income respectively. The company’s income from customer A fell to 14.742 million yuan, accounting for 13.8% of the income; Customer B fell out of the top five customers of the company.

Source: prospectus

In 2022, the fifth largest customer "related customers" in 2021 became the largest customer of Semir Technology. The company’s income from this "related customer" is 35.5 million yuan, accounting for 24.4% of the total income. In addition to related customers, the other four customers in the top five customers are the top five new customers.

Source: prospectus

In the first half of 2023, the largest customer of Semu Technology became China Merchants Testing Vehicle Technology Research Institute Co., Ltd. (hereinafter referred to as "China Merchants Testing"). Semu Technology said that the revenue from China Merchants Testing was 9.396 million yuan, accounting for 43.4% of the total revenue. The income of related customers is 4.489 million yuan, accounting for 20.8% of the income. At the same time, in addition to related customers, the other four customers in the top five customers are the top five new customers.

Source: prospectus

According to the prospectus, the related customer is Huawei and its related companies, and it is a leading provider of information and communication technology solutions and smart devices in the world.

In the prospectus, Semir Technology stated that in 2021, it jointly launched the first cloud-based ICV simulation test platform in China with the relevant customers, but did not make any profit-sharing arrangement for the project of developing the cloud-based ICV simulation test solution. Semir Technology will not sign a contract with the automobile manufacturer directly, but will sign a contract with the automobile manufacturer through the relevant customers, and the relevant customers will subcontract part of the main contract to the company.

Semu Technology admits that if the cooperation with relevant customers is terminated, it may be necessary to sign contracts with other third parties specializing in cloud technology, or greatly improve the ability to develop and deliver simulation test solutions through its own cloud functions or in the form of non-cloud independent software. According to the prospectus, the cooperation between the company and related customers will last until March 21, 2024.

In addition, the prospectus shows that the cooperation period of the two cooperation projects between Semu Technology and China Merchants Testing in the first half of 2023 is three months.

On December 27th, 2023, regarding the cooperation between the company and Huawei and the high customer concentration, the reporter of Time Weekly sent an interview outline to Semu Technology official website mailbox, but as of press time, there was no effective reply. On December 28th, the reporter of Time Weekly called official website for many times, but no one answered.

Valuation has increased by nearly 174 times in four years.

However, what attracts people’s attention is not only its star shareholders, but its rapidly expanding valuation.

On January 24th, 2014, Semir Technology was established by CCID Group, the parent company of CCID Testing, and Beijing Bangbang. At the beginning of its establishment, it was aimed at detecting network vulnerabilities of mobile applications.

Among them, CCID Group is a state-owned enterprise under CCID, a unit directly under the Ministry of Industry and Information Technology, and owns 51% of the company’s equity; Beijing Bangbang is dedicated to providingPrivate enterprises that serve the company own 49% of the company’s shares.

However, the cooperation between CCID Group and Beijing Bangbang did not go as expected. In mid-2017, CCID Group, as an entity under the Ministry of Industry and Information Technology, which regulates the ICV testing industry, plans to develop an ICV algorithm testing and simulation system. Through past business contacts, it got to know Ma Lei, the current executive director of Saimu Technology, and invited its management team to research and develop the system.

On March 15, 2018, for the commercialization of R&D achievements, the management teams Ma Lei, Hu Dalin and He Feng invested in Semir Technology through the investment holding platform Space Technology and started the operation of ICV testing related business, and obtained 44% equity of Semir Technology from Beijing Bangbang at a price of 440,000 yuan. Before the IPO, Space Technology was wholly owned by Hu Dalin, Ma Lei and He Feng respectively, accounting for about 64.1%, 25.6% and 10.3%.

On June 26, 2018, Semu Technology increased its capital by 40,800 yuan to 1,040,800 yuan for the first time, with 38,800 yuan and 2,000 yuan subscribed by Spacetech and Beijing Bangbang respectively. On November 27th of the same year, CCID Group transferred 49% equity of Semir Technology to CCID, a wholly-owned subsidiary of CCID Group, at zero cost. After the capital increase and transfer, Space Technology, CCID Testing and Beijing Bangbang respectively own 46%, 49% and 5% equity of Semir Technology. At this time, CCID Testing became the largest shareholder of the company.

On September 26, 2019, Space Technology and the newly established employee incentive platform Tongda increased their capital to Semu Technology, and subscribed for the increased registered capital of 69,400 yuan and 277,500 yuan at the cost of 666,700 yuan and 2,666,700 yuan respectively. At this time, the corresponding value of every 10,000 yuan of registered capital is about 96,100 yuan. After the completion of this round of capital increase, the registered capital of Semu Technology reaches 1,387,700 yuan. Based on this calculation, the company’s valuation is about 13.3358 million yuan. Space Technology and Tongda own 39.5% and 20% equity of Semu Technology respectively.

On January 10th, 2020, Semu Technology increased its capital for the third time, and Gongqingcheng Zhiyuan subscribed for the increased registered capital of 69,385 yuan at the cost of 5 million yuan. After the completion of this round of capital increase, the registered capital of Semu Technology reached 1,457,100 yuan. In this round of capital increase, the corresponding value of registered capital of 10,000 yuan is about 720,600 yuan, and the company’s valuation based on this calculation is about 105 million yuan.

On July 1, 2021, Semir Technology completed the A round of financing, and introduced strategic investors such as Beijing Shunyi, Hubble Technology, Beijing Cornerstone, CITIC Investment and Jingwei Hengrun. Five A round strategic investors subscribed for the company’s increased registered capital of 51,427 yuan at a cost of 30 million yuan. After the completion of this round of capital increase, the registered capital of Semu Technology reached 1,714,200 yuan. At this time, the corresponding value of the registered capital of 10,000 yuan is about 5,833,500 yuan, and the company’s valuation based on this calculation is about 1 billion yuan.

On March 7 and May 12, 2022, Semir Technology completed the A+ round of financing and introduced strategic investors such as Gongqingcheng Junhe. Each A+ round of strategic investors subscribed for the increased registered capital of the company at a cost of 66 million yuan. After the completion of this round of capital increase, the registered capital of Semu Technology reached 1,817,100 yuan. At this time, the corresponding value of 10,000 yuan of registered capital is about 12,833,700 yuan, and the company’s valuation based on this calculation is about 2,332 million yuan.

At this time, compared with the valuation of the company’s second capital increase in 2019, it increased by 173.87 times, and the time span was less than 4 years.

On October 16, 2022, Semu Technology completed the share reform and changed to a company limited by shares.

Before the IPO, Space Technology and Tongda owned a total of 45.5% of the interests of Semu Technology and were the controlling shareholders of the company. Among them, space technology is wholly owned by the company management team; As an employee incentive platform, Tongda is mainly controlled by the management team. The management teams Hu Dalin, He Feng and Ma Lei own about 50.0%, 43.6% and 2.1% of the shares of Tongda respectively, while the other 15 employees of the company only own 4.3% of the shares.

On December 22, 2023, the China Securities Regulatory Commission issued the Requirements for Supplementary Materials for Overseas Issuance and Listing (December 15, 2023—December 21, 2023), which required Semitech to issue supplementary materials, involving employee stock ownership plan, changes in share capital and shareholders’ situation, and state-owned assets management procedures. In particular, it was required to supplement the specific reasons for not fulfilling the state-owned assets management procedures such as the state-owned equity logo, the expected time of submitting the application, and whether it would be necessary for this issuance.

As of January 4, 2024, Semu Technology has not yetRelevant supplementary materials.